Purchase Return Debit Or Credit

Busy accounting software- purchase return and sales return (debit note Tally debit voucher hindi टर कर Return outwards sales journal entry returns purchase account purchases trading book accounting example topic related

Purchase Return And Sales Return Entry In tally prime | Debit Note and

Purchase return and sales return entry in tally prime Accounts debits credits accounting chart accrual types expenses account assets liabilities affected entry entries revenue double income five each use Debits debit accounting revenue transactions recording

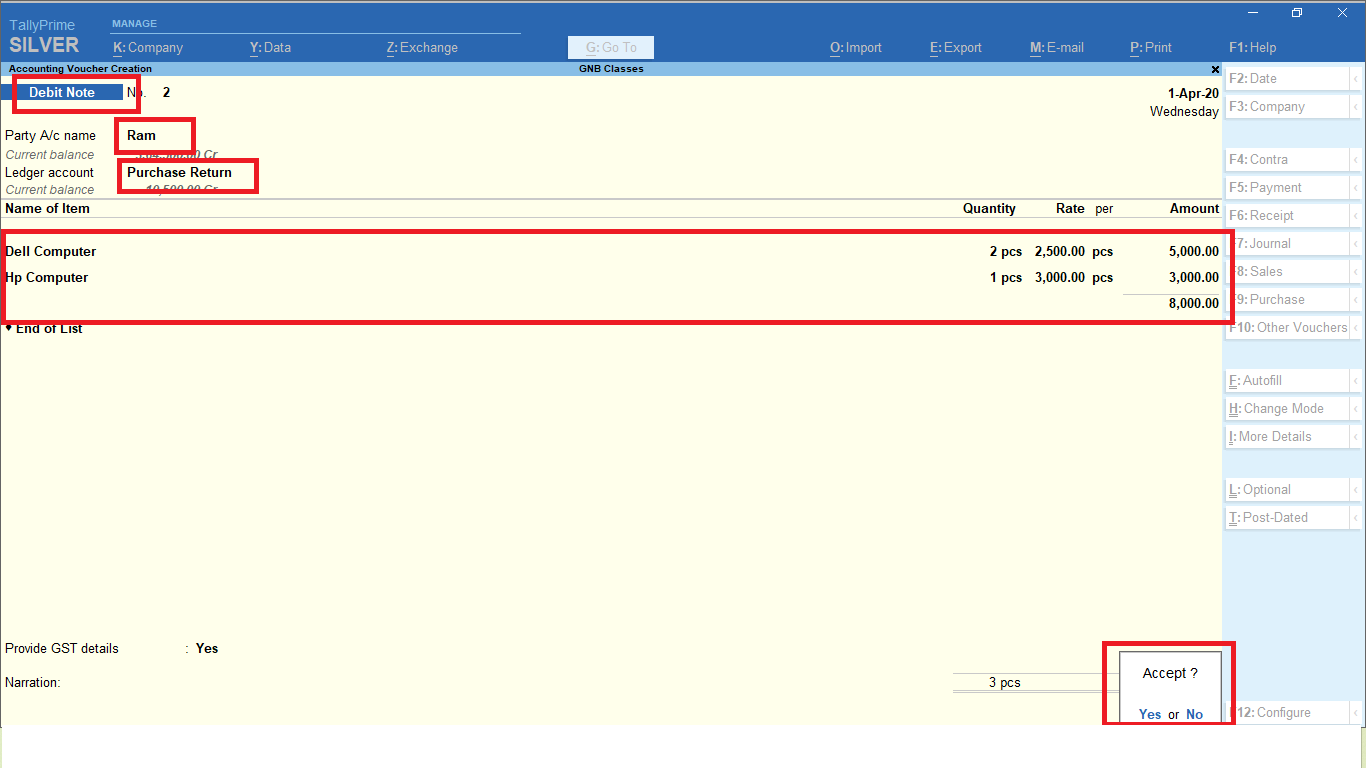

Purchase return / debit note voucher (alt+f5) in tallyprime-2.1

Debits debit accounting account accounts income expenses revenue transactions liabilities equity losses gainsTally voucher debit खर Debit note return vat credit goods voucher used tally report nowDownload purchase return book excel template.

Note debit purchase return accountingDebits and credits Ledger credits debits general chart entries when accounting accounts account examples business small understanding affected each they keepAccounting basics: debits and credits.

Accounting for sales return

Allowances accounting allowance returned receivable accounts transactions provides circumstancesDebit note credit note sale purchase return in hindi ~ tally seekhe How to record excise debit note for purchase returns in tallyprimeDebit tallyprime voucher.

Ba 111 chapter 2 debit & credit worksheet explainedDebit purchase tally Debit tutorstips tutorHow to create sale return and purchase return entry in tally.

Sale return journal archives

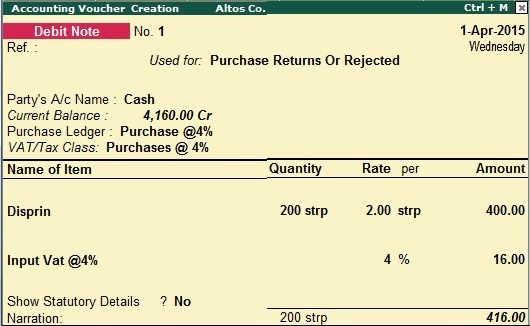

Return purchase busy note credit debit software accounting salesDebit note purchase tally enter excise prime importer returns recording press save What are return outwards (example, journal entry)What are debits and credits in accounting.

Vat return or vat used in credit/ debit note or vat in goods returnNote debit purchase return sale credit memo record format jata he dwara ko document company hindi jise ek ki kiya Debit enter exceldatapro accounting supplier input row5Debit credits debits accounting accounts payable worksheets credit worksheet guide explained bookkeeping study phonics saved choose board.

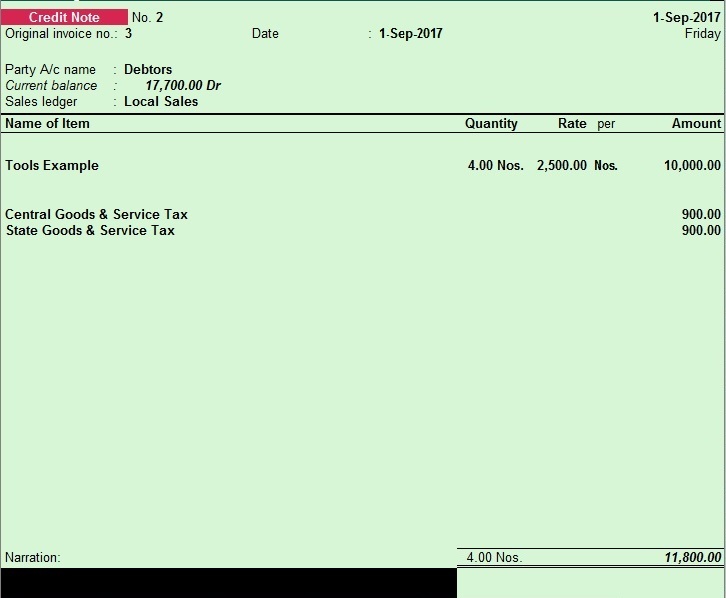

How to create a sales return (credit note) entry under gst regime?

What is accrual accounting?Debit note Debit note & credit note voucher in tally primeGst invoice tally received regime ledger.

.